Gen Z, Real Estate & What We’re Trying to Do About It

For our parents’ generation, given the opportunities they had, the formula for a stable life was simple: save money, build a home, buy land. Real estate was the most trusted path to wealth — slow, steady, and safe, the traditional Indian way. It may sound like a familiar cliché, I know.

But Gen Z sees things differently. We are driven by status and experiences. For many of us, the traditional idea of stability feels less like a dream and more like a cage. Our ambition isn’t to wait until our 60s to enjoy life. It’s to live well now — to maximize experiences, freedom, and status today, not decades later.

That’s why you’ll notice something unusual and new: many of my friends in their early 20s already earn as much as, or more than, their parents — and often live at standards their parents couldn’t have afforded at the same age. Instead of pouring that money into static assets like houses, they chase better lifestyles. Owning one immovable property that may reap fruit decades later feels limiting. What excites them more is mobility, passive income, and the ability to live and work anywhere.

Regardless of the popular stereotypes about Gen Z, it’s true that many often make impulsive financial decisions — overspending on lifestyle, trading recklessly, or ignoring long-term planning. But here’s the upside: they also start investing earlier than any generation before them. Stocks, mutual funds, and digital assets are already part of their vocabulary in their 20s. So even if they stumble early, they’ll learn fast. They are also the generation most willing to give new experiences, products, entrepreneurs, and businesses a chance — and in doing so, they show themselves to be surprisingly high-trust people. This is a generation that not only wants more for themselves, but also actively aspires to have better infrastructure, smarter systems, and higher standards of living

So to them Traditional real estate feels boring. But what doesn’t feel boring is the idea of mobile real estate assets — properties you can buy, sell, rent, or even live in, as easily as you might trade stocks online.

Imagine this: you own a slice of a property somewhere in Northeast India. You never even visited. No endless paperwork. Just a few clicks, like buying shares. From that slice, you earn rental income. You can also choose to live there yourself. And if the value appreciates, you sell it — the same way you’d sell a stock.

This kind of system wouldn’t just create wealth for individuals. It would push infrastructure development across India, extending opportunity to cities and towns that today feel remote.

But for that to happen, we need more than imagination. We need standardization at massive scale. Buying and selling property in India today is messy, opaque, and inconsistent. Even something as basic as renting a property for long-term living often involves endless searching, unreliable listings, and unethical brokers. Maintenance, billing, electricity, housekeeping — everything works differently depending on where you are. The real estate and accommodations market in India is a low-trust environment, riddled with unfair practices and a lack of transparency. To unlock a real estate future as fluid as the stock market, we need to enforce common rules and processes at scale. Think of it the way the National Stock Exchange and SEBI standardized and regulated equities.

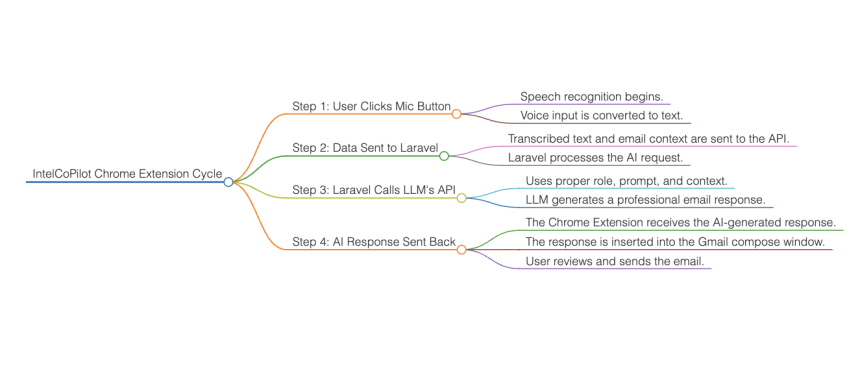

That’s what we’re trying to build with Sheltr (Currently a side project).

At first, Sheltr will start small: a student accommodations marketplace. Today, students face countless problems when renting — overpriced stays, unfair maintenance charges, withheld security deposits, and confusing or unethical dealings with brokers. Sheltr is built to solve these issues. It provides a trusted space where students can find affordable stays, with standardized rules for rent, maintenance, and refunds, ensuring transparency and fairness in their long-term stay.

For property owners and managers, Sheltr wont be just another OYO or Airbnb clone that bleeds money through service fees. It’s a premium software platform that helps them manage properties at scale, track rentals seamlessly, and operate under standardized billing and processes. By building trust and transparency into the system, Sheltr also addresses the larger market problem: a low-trust ecosystem where unfair practices are common.It will create long-term value for both owners and tenants

Our long-term bet is simple: if we can standardize rentals for students, we can standardize them for everyone. And once we do that, real estate stops being heavy and static, and starts being fluid, tradeable, and accessible.

I think this is a very interesting problem to solve, and one that will stay relevant in the coming decades.